Wealth Path Crypto vs. Traditional Investments – A Complete Guide

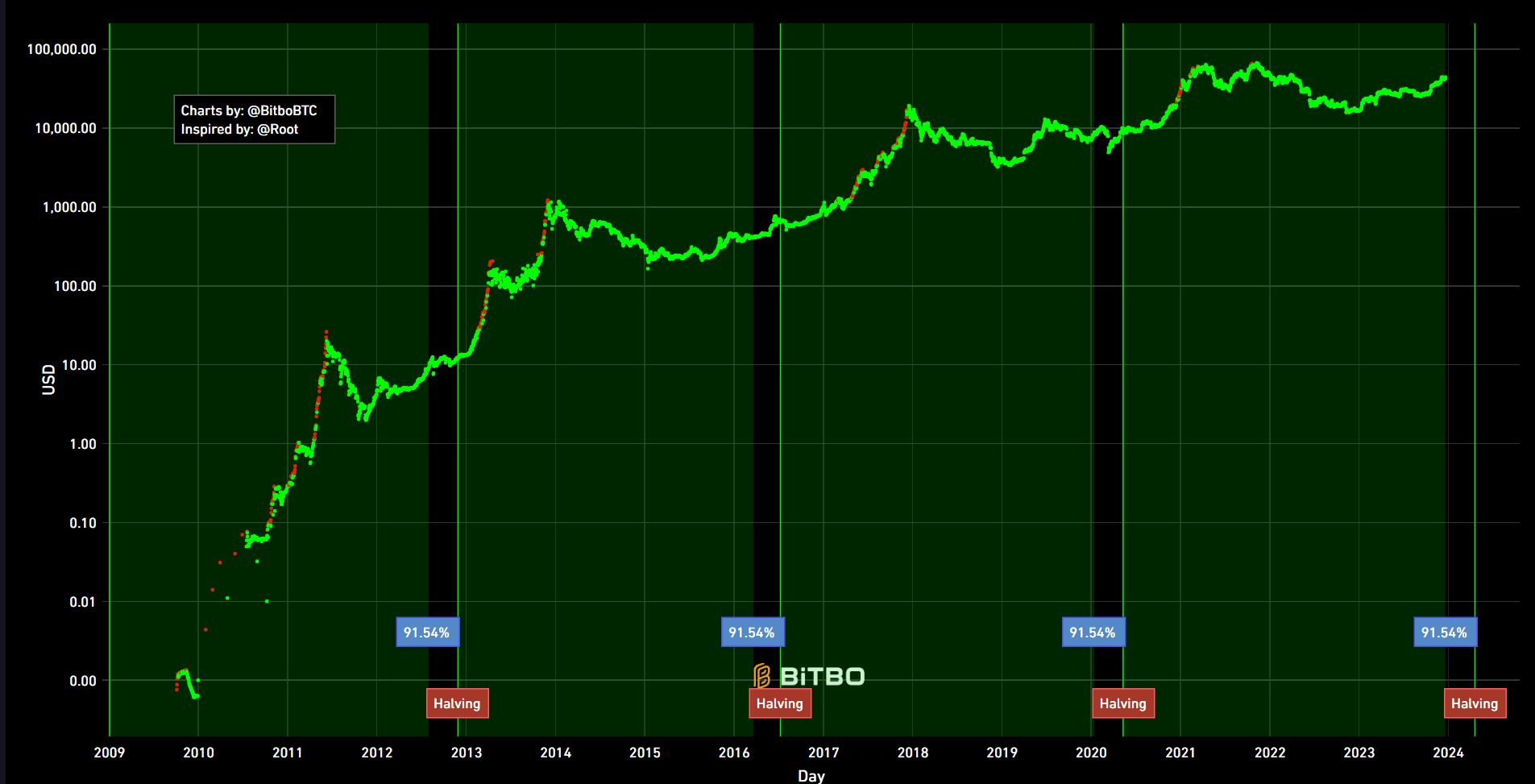

If you want long-term stability, allocate at least 60% of your portfolio to traditional assets like index funds and real estate. For higher growth potential, dedicate 10-30% to cryptocurrencies–but only what you can afford to lose. Historical data shows S&P 500 returns average 7-10% annually, while Bitcoin’s CAGR since 2010 exceeds 200%.

Traditional investments offer predictable cash flow with lower volatility. Dividend stocks pay quarterly, bonds provide fixed income, and rental properties generate monthly revenue. Crypto markets move faster–Ethereum gained 1,500% in 2021 but dropped 70% the next year. Adjust your strategy based on risk tolerance: passive investors favor ETFs, while active traders exploit crypto’s 24/7 price swings.

Diversification matters more than picking winners. A balanced mix might include 50% stocks, 20% bonds, 15% real estate, and 15% crypto. Rebalance quarterly–sell outperforming assets to buy undervalued ones. Tax efficiency also differs: long-term stock holdings get lower capital gains rates, while crypto trades trigger taxable events instantly.

Liquidity needs dictate your approach. Selling stocks takes 2-3 days; crypto exchanges process withdrawals in minutes. But remember–traditional markets have stricter regulations, while crypto scams drained $3.8 billion in 2022 alone. Always verify projects’ whitepapers and teams before investing.

Wealth Path: Crypto vs Traditional Investments Complete Guide

Allocate 5-15% of your portfolio to crypto if you seek growth but can tolerate volatility. Traditional assets like stocks and bonds should form the core (60-80%) for stability. Balance risk by diversifying across both.

Crypto returns often outperform stocks–Bitcoin gained 900% in five years vs S&P 500’s 80%. But crashes hit harder: BTC dropped 65% in 2022 while the S&P lost 19%. Use dollar-cost averaging to mitigate swings.

Traditional investments offer predictable income. Dividend stocks pay 2-4% annually, and bonds yield 3-6%. Crypto lacks dividends but staking rewards can generate 3-12% APY on tokens like Ethereum or Solana.

Liquidity differs sharply. Stocks settle in two days; crypto trades 24/7 with instant settlements. This flexibility helps capitalize on overnight moves but increases impulsive decisions.

Tax rules vary. Long-term stock gains face 15-20% taxes; crypto trades trigger taxable events even when swapping coins. Track transactions with tools like WealthPath to simplify filings.

Security demands attention. Cold wallets (Ledger, Trezor) protect crypto better than exchanges. Traditional brokers like Fidelity or Vanguard insure accounts up to $500,000.

Start small. Test crypto with $100-500 monthly buys while maxing out IRA/401(k) contributions first. Rebalance quarterly to maintain your target allocation.

How to Allocate Funds Between Crypto and Stocks for Long-Term Growth

Split your investments between crypto and stocks based on risk tolerance and time horizon. A balanced approach for moderate investors is 60% stocks and 40% crypto, adjusting as needed.

Assess Your Risk Profile

If you prefer stability, allocate 70-80% to stocks like index funds (e.g., S&P 500) and 20-30% to established cryptocurrencies such as Bitcoin or Ethereum. For higher risk tolerance, flip the ratio–50% or more in crypto, focusing on blue-chip coins and selective altcoins.

Rebalance quarterly. If crypto gains outpace stocks, trim profits to maintain your target allocation. For example, if your crypto portion grows from 40% to 55%, sell 15% and reinvest in stocks.

Diversify Within Each Asset Class

In stocks, mix large-cap, small-cap, and international ETFs. For crypto, combine Bitcoin (40-50% of crypto allocation), Ethereum (20-30%), and a few high-potential altcoins (10-20%). Avoid putting more than 5% into speculative tokens.

Use dollar-cost averaging (DCA) for both. Invest fixed amounts monthly–$500 in stocks and $300 in crypto–to reduce volatility impact. Automated tools like recurring buys on Coinbase or brokerage apps simplify this.

Keep an emergency fund in cash or bonds before investing. Never allocate funds you’ll need within 3-5 years to crypto due to its volatility.

Tax and Legal Considerations When Switching from Traditional Assets to Crypto

Report every crypto transaction to tax authorities–most countries classify cryptocurrencies as taxable assets. In the U.S., the IRS treats crypto as property, meaning capital gains rules apply when selling, trading, or spending it.

Track your cost basis for each transaction. Use tools like CoinTracker or Koinly to automate calculations and avoid errors. Missing records can lead to audits or penalties.

Check local regulations before converting traditional assets to crypto. Some jurisdictions require disclosures for large transfers. For example, the EU’s Sixth Anti-Money Laundering Directive (6AMLD) mandates stricter reporting for crypto transactions over €1,000.

Consider tax-loss harvesting to offset gains. If a crypto investment drops in value, selling it can reduce your taxable income. Reinvest carefully–wash sale rules may apply in some regions.

Hold crypto for over a year in the U.S. to qualify for long-term capital gains rates (0%-20%). Short-term holdings are taxed as ordinary income, which can exceed 40%.

Verify if your country imposes wealth or exit taxes on crypto. Portugal taxes crypto gains but not holdings, while India enforces a 30% flat tax on profits.

Use regulated exchanges with KYC compliance. Unlicensed platforms may expose you to legal risks or frozen funds. Platforms like Coinbase and Kraken provide tax documents to simplify reporting.

Consult a crypto-savvy accountant. Tax laws vary by jurisdiction, and mistakes can be costly. Professionals help structure transactions efficiently–like using IRA accounts for tax-deferred crypto growth.

FAQ:

What are the key differences between investing in crypto and traditional assets like stocks or bonds?

Crypto investments are decentralized, highly volatile, and operate 24/7, while traditional assets like stocks and bonds are regulated, generally more stable, and trade during market hours. Crypto offers faster growth potential but carries higher risk, whereas traditional investments provide slower, steadier returns with lower volatility.

How do taxes work for crypto compared to traditional investments?

Crypto transactions often trigger taxable events, such as trading or spending, and tax rules vary by country. Traditional investments like stocks are taxed on capital gains and dividends. Crypto taxes can be more complex due to frequent trades, airdrops, and staking rewards, requiring careful tracking.

Is crypto a better long-term investment than stocks or real estate?

Crypto has higher growth potential but also greater uncertainty. Stocks and real estate have long-term stability backed by tangible value. Diversifying across both can balance risk—crypto for aggressive growth, traditional assets for steady wealth preservation.

What are the safest ways to store crypto versus traditional investments?

Crypto requires secure wallets (hardware for large amounts, reputable software for smaller sums). Traditional investments are held in regulated brokerages or banks with insurance protections. Crypto lacks institutional safeguards, so self-custody and backup measures are critical.